JFC Reports Financial Results for the First Quarter of 2022: Sales Up 26%, Operating Income Rises by 34%

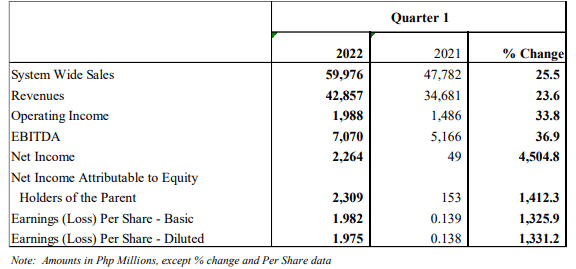

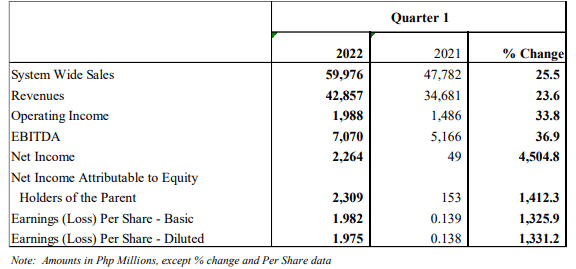

Following are highlights of the unaudited consolidated financial results of operations of Jollibee Foods Corporation and its subsidiaries for the quarter ended March 31, 2022:

Jollibee Foods Corporation (JFC), one of the largest Asian food service companies, reported today that its system wide sales, a measure of all sales to consumers both from company-owned and franchised stores grew by 25.5% to Php60.0 billion in the first quarter of 2022 driven by strong same store sales growth of 16.5% and global store network expansion and new acquisition, which contributed 5.5%. Currency translation added 3.5% to the growth.

JFC’s system wide sales for the first quarter of 2022 includes sales of Milksha, a popular Taiwanese bubble tea brand. JFC, through its 100% owned subsidiary, Jollibee Worldwide, Pte. Ltd. (JWPL) completed the acquisition of 51% stake in Milkshop International Co. Ltd., the company that owns Milksha on February 22, 2022. The consolidation of Milkshop did not have a significant impact on the JFC Group’s sales and profit for the first quarter.

Global same store sales for the first quarter of 2022 grew by 16.5% compared to the same quarter of 2021, led by The Coffee Bean and Tea Leaf® (CBTL) which grew by 23.3%, the Philippine business by 22.9%, North America by 8.1% and EMEAA (Europe, Middle East, and Asia) by 6.2%. The China business’ same store sales declined by 9.1% due to heightened COVID-related restrictions imposed on key cities.

Operating income increased by 33.8% to Php2.0 billion in the first quarter of 2022 driven by the acceleration of profit growth in the Philippines. Gross profit margin was slightly below year-ago level due to rising inflation rate and higher freight charges. JFC implemented price adjustments in 2021 and Q1 2022 and continued with internal cost efficiencies to support its profit margins.

Mr. Richard Shin, JFC’s Chief Financial Officer disclosed that JFC’s raw material prices have increased over the same period in 2021. “Costs are accelerating because of higher inflation and broad based supply chain challenges. JFC will take the necessary steps to protect its margins including implementing cost improvement and revenue management initiatives,” Mr. Shin stated.

Compared with pre-pandemic levels, total system wide sales and revenues in Q1 2022 were already ahead by 10.5% and 6.2%, respectively versus Q1 2019. Operating income was slightly lower by 5.2% while net income attributable to equity holders of the Parent Company was higher by 58%.

JFC’s Chief Executive Officer, Mr. Ernesto Tanmantiong gave the following statement: “Despite the challenges brought about by the surge in Omicron variant in some markets where JFC operates and the increase in prices of raw materials and energy, our business performed well and even set new record for sales for a first quarter. System wide sales of our businesses in China, North America (Philippine brands), EMEAA including SuperFoods have reached pre-pandemic levels driven by continued store expansion. The store network of our foreign business for Q1 2022 grew by 20.3% organically (excluding acquisitions) compared to Q1 2019, in line with our long-term growth model. Sales of our Philippine business were still below pre-pandemic levels, but are showing sustained strong growth for off-premise sales which grew by 57% compared to the first quarter of 2019, offsetting the decline in dine-in sales. Delivery sales accounted for ~20% of the Philippine business’ system wide sales and have grown five-fold since 2019. In terms of operating profit, the Philippine business performed better compared to the first quarter of 2019 despite a decline in revenues and rising inflation. The Business Transformation Program implemented in 2020 and the continuing strong cost and profit management of the JFC Group made this possible.”

Net income attributable to equity holders of the Parent Company for the first quarter amounted to Php2.3 billion compared to Php152.6 million for the first quarter of 2021. The net income for the first quarter of 2022 includes gains from the transfer of certain land properties of the JFC Group to CentralHub and sale of other land properties amounting to Php1.8 billion. The land conveyance is part of the JFC Group’s plan to invest in CentralHub, which the JFC Board of Directors approved on July 7, 2021. CentralHub is a company in the industrial real estate business. The plan includes additional investments by the JFC Group through exchange of its land assets to CentralHub’s shares of stocks, which was put in effect on March 24, 2022, as agreed by the parties.

JFC declared on April 19, 2022 a regular cash dividend of Php1.07 per share of common stock, an increase of 37.2% versus the cash dividend declared in the same period in 2021. On the same date, the JFC Board of Directors also approved the declaration of a regular cash dividend of P8.20525 per share for Series A preferred shares and P10.60125 per share for Series B preferred shares to be given to JFC stockholders of record as of June 22, 2022 and September 21, 2022. Payment dates are on July 14, 2022 and October 14, 2022, respectively.

The JFC Group opened 107 new stores in the first quarter: 19 in the Philippines, 19 in China, 9 in North America and 13 in EMEAA. SuperFoods and CBTL opened 19 and 28 stores, respectively. A total of 58 stores were permanently closed during the quarter: 14 in the Philippines and 44 abroad.

JFC has 18 brands in 34 countries. At the end of March 31, 2022, JFC was operating 6,246 stores worldwide: 3,225 in the Philippines and 3,021 in international: 468 in China, 379 in North America, 310 in EMEAA, 538 with SuperFoods mainly in Vietnam, 1,062 with CBTL and 264 with Milksha. Its largest brands by store outlets worldwide are Jollibee with 1,538, Coffee Bean & Tea Leaf 1,062, Chowking 608, Mang Inasal 577 and Highlands Coffee 500.

Following are highlights of the unaudited consolidated financial results of operations of Jollibee Foods Corporation and its subsidiaries for the quarter ended March 31, 2022:

Jollibee Foods Corporation (JFC), one of the largest Asian food service companies, reported today that its system wide sales, a measure of all sales to consumers both from company-owned and franchised stores grew by 25.5% to Php60.0 billion in the first quarter of 2022 driven by strong same store sales growth of 16.5% and global store network expansion and new acquisition, which contributed 5.5%. Currency translation added 3.5% to the growth.

JFC’s system wide sales for the first quarter of 2022 includes sales of Milksha, a popular Taiwanese bubble tea brand. JFC, through its 100% owned subsidiary, Jollibee Worldwide, Pte. Ltd. (JWPL) completed the acquisition of 51% stake in Milkshop International Co. Ltd., the company that owns Milksha on February 22, 2022. The consolidation of Milkshop did not have a significant impact on the JFC Group’s sales and profit for the first quarter.

Global same store sales for the first quarter of 2022 grew by 16.5% compared to the same quarter of 2021, led by The Coffee Bean and Tea Leaf® (CBTL) which grew by 23.3%, the Philippine business by 22.9%, North America by 8.1% and EMEAA (Europe, Middle East, and Asia) by 6.2%. The China business’ same store sales declined by 9.1% due to heightened COVID-related restrictions imposed on key cities.

Operating income increased by 33.8% to Php2.0 billion in the first quarter of 2022 driven by the acceleration of profit growth in the Philippines. Gross profit margin was slightly below year-ago level due to rising inflation rate and higher freight charges. JFC implemented price adjustments in 2021 and Q1 2022 and continued with internal cost efficiencies to support its profit margins.

Mr. Richard Shin, JFC’s Chief Financial Officer disclosed that JFC’s raw material prices have increased over the same period in 2021. “Costs are accelerating because of higher inflation and broad based supply chain challenges. JFC will take the necessary steps to protect its margins including implementing cost improvement and revenue management initiatives,” Mr. Shin stated.

Compared with pre-pandemic levels, total system wide sales and revenues in Q1 2022 were already ahead by 10.5% and 6.2%, respectively versus Q1 2019. Operating income was slightly lower by 5.2% while net income attributable to equity holders of the Parent Company was higher by 58%.

JFC’s Chief Executive Officer, Mr. Ernesto Tanmantiong gave the following statement: “Despite the challenges brought about by the surge in Omicron variant in some markets where JFC operates and the increase in prices of raw materials and energy, our business performed well and even set new record for sales for a first quarter. System wide sales of our businesses in China, North America (Philippine brands), EMEAA including SuperFoods have reached pre-pandemic levels driven by continued store expansion. The store network of our foreign business for Q1 2022 grew by 20.3% organically (excluding acquisitions) compared to Q1 2019, in line with our long-term growth model. Sales of our Philippine business were still below pre-pandemic levels, but are showing sustained strong growth for off-premise sales which grew by 57% compared to the first quarter of 2019, offsetting the decline in dine-in sales. Delivery sales accounted for ~20% of the Philippine business’ system wide sales and have grown five-fold since 2019. In terms of operating profit, the Philippine business performed better compared to the first quarter of 2019 despite a decline in revenues and rising inflation. The Business Transformation Program implemented in 2020 and the continuing strong cost and profit management of the JFC Group made this possible.”

Net income attributable to equity holders of the Parent Company for the first quarter amounted to Php2.3 billion compared to Php152.6 million for the first quarter of 2021. The net income for the first quarter of 2022 includes gains from the transfer of certain land properties of the JFC Group to CentralHub and sale of other land properties amounting to Php1.8 billion. The land conveyance is part of the JFC Group’s plan to invest in CentralHub, which the JFC Board of Directors approved on July 7, 2021. CentralHub is a company in the industrial real estate business. The plan includes additional investments by the JFC Group through exchange of its land assets to CentralHub’s shares of stocks, which was put in effect on March 24, 2022, as agreed by the parties.

JFC declared on April 19, 2022 a regular cash dividend of Php1.07 per share of common stock, an increase of 37.2% versus the cash dividend declared in the same period in 2021. On the same date, the JFC Board of Directors also approved the declaration of a regular cash dividend of P8.20525 per share for Series A preferred shares and P10.60125 per share for Series B preferred shares to be given to JFC stockholders of record as of June 22, 2022 and September 21, 2022. Payment dates are on July 14, 2022 and October 14, 2022, respectively.

The JFC Group opened 107 new stores in the first quarter: 19 in the Philippines, 19 in China, 9 in North America and 13 in EMEAA. SuperFoods and CBTL opened 19 and 28 stores, respectively. A total of 58 stores were permanently closed during the quarter: 14 in the Philippines and 44 abroad.

JFC has 18 brands in 34 countries. At the end of March 31, 2022, JFC was operating 6,246 stores worldwide: 3,225 in the Philippines and 3,021 in international: 468 in China, 379 in North America, 310 in EMEAA, 538 with SuperFoods mainly in Vietnam, 1,062 with CBTL and 264 with Milksha. Its largest brands by store outlets worldwide are Jollibee with 1,538, Coffee Bean & Tea Leaf 1,062, Chowking 608, Mang Inasal 577 and Highlands Coffee 500.